Level2StockQuotes.com

Level2StockQuotes.com

For Day Traders and Investors..

Level II Stock Quotes

US Day Traders and Investors..

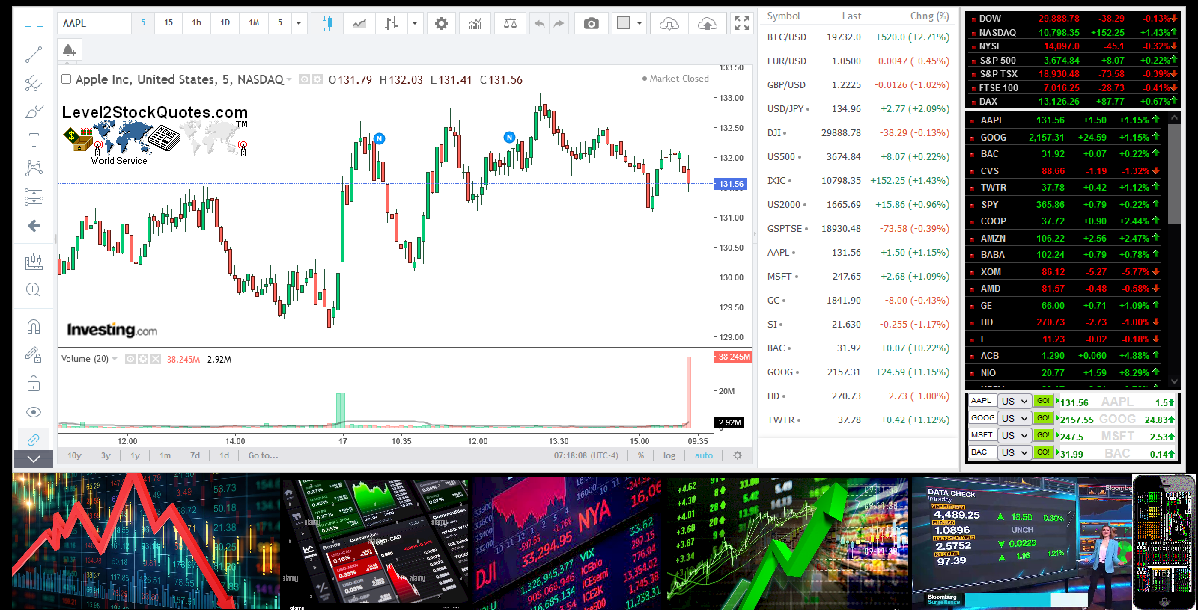

Live Stock Charts

Live Stock Charts for Indicators..

TSX Stock Quotes

CA TSX Traders and Investors..

Level2StockQuotes.com - Futures Trading Markets Commodities - Articles

Features a introduction into the futures trading markets, commodities trading, and some history..

Futures Trading Introduction and Articles for Investors, Futures Markets Speculators and Hedgers..

The futures trading markets are a meeting place for buyers and sellers of many different commodities futures like financial futures, oil futures, gold futures, silver futures, copper futures and many more. The futures trading market is a continuous commodities futures auction and used for showing information about future supply and demand, foreign currencies and stock indexes. Futures trade daily and are mainly used by producers, consumers and speculators in the futures trading markets.

Futures Trading Market Brief History:

The trading floor of the futures exchange, with all the shouting and signaling to buy or sell commodities does give the direct impression of chaos. In reality prior to the grain markets being established in the middle of the nineteenth century, the farmers would harvest their crops in the fall of the year and bring their crop to market. The farmers would try to bring their crop to one of the major populated areas and transportation centers to sell to buyers. Seasonal glut was a major concern for the farmer as it drove prices to nearly nothing.

Futures Trading Floor Traders:

Local people who buy and sell futures contracts or stocks on the floor of the exchanges are known as floor traders. The floor trader is similar to the market makers and specialists, they help provide liquidity in the market. Floor traders also can make trades on their own accounts, but unlike the market maker or specialists, the floor traders participating in the market are not known and fully understood.

Futures Trading Hedgers:

The principle of hedgers is simple but can be somewhat complex. In this article we attempt to clarify futures hedgers and what benefit they have. The hedgers in the futures market buy and sell futures contracts mainly to establish a price level many weeks or even months in advance, this is done to establish a know futures price level for goods they later intend to buy or sell in the cash market or bond market. Some hedgers use the futures market to lock in a price that is acceptable somewhere between their buy and sell price, this is a margin between the two prices.

Futures Trading Speculators:

To speculate in futures contracts oil futures, gold futures or other commodities, first you must decide with the help of your futures investment broker or investment advisor what futures to buy and when. If you decide to speculate in the futures markets, or any futures commodities, gold futures or oil futures contracts, only buy when you are confident in your analysis and decision that the futures commodity you are going to buy, will increase in value within the time frame you set with your futures broker. After you place your order to buy futures contracts, if someone takes the opposite side of your trade it possibly could be a hedger or another speculator who has a different opinion from your own as to what direction the futures contracts price will be.

Futures Trading Markets Commodities - Article Continued...

World Charts - Trading Snapshot News Articles

US CA Level 2 Mobile

CA Level 2 Mobile

CA Level 2 Mobile FX Level 2 Mobile

US Level 2 Mobile Level 2 stock quotes mobile is setup for all Mobile Devices - Featuring realtime stock quotes on your ipad, iphone or smart phone. Live Stock Charts and Stock Market TV News plus Stock Trading Snapshot News Articles, stock market watch list and day trading tips. For Stock Trading Snapshot News Articles simply select from the Drop-Down Chart Menu above. Use the Stock Market Movers and Stock Screener section to find stocks that are moving fast or have reached a new high or low with volume coming in fast. Forex Trading Currencies see the Forex or FX section in any of the drop-down menus for charts and quotes for GOLD, SILVER or Dollar Rates, Canadian Dollar and many more. For free Level II Stock Quotes click on LII-Book button.

Futures Trading Markets Commodities - Article Continued...

Futures Trading What is a Futures Contract:Futures contracts consist of two main contracts, futures contracts that are for real delivery of a commodity and those futures contracts that are for a cash settlement.

Futures cash settlement is simply the holding of a cash settled future until expiration. At that time, there is a final margin payment, and the contract expires.

Very few futures contracts are the delivery type of contract. Most hedgers, speculators and investors in the futures markets do not have any desire to take delivery of say 500,000 pound of grain or sugar contracts they bought or sold.

Level II Stock Quotes

For NASDAQ, NYSE and AMEX stocks. Level II Stock Quotes also features live stock charts, most active stocks and stock market news. For level II quotes click on LII-Book button.

Features free level 2 stock quotes, live stock charts, most active stocks, stock market watch list and stock market news for NASDAQ, NYSE, AMEX stocks. Market hours 4:00 am to 8:00 pm.

Features live stock quotes, stock market watch list, news and live candlestick stock charts for NASDAQ, NYSE, AMEX and OTCBB stocks. You can see what a stock is doing, watch the open and close of the stock trade and compare to the previous trade to give you a better view.

Features real time NASDAQ, NYSE and AMEX, hot Penny stocks that are trading up in today's session and are below $5 dollars with volume coming in moving the stock market price higher. Volume is also an indicator of a stocks momentum and if you get in early, the earnings potential is at it's greatest, just make sure your on the right side of the trade and don't fight against the overall market trend.

Thousands of stock transactions take place everyday, not only in the United States but also all over the world. When a stock is bought and sold, it has two kinds of prices, a bid price and an ask price. The bid price is what someone is willing to pay for the stock.

CA TSX Stock Quotes

Features Free real-time stock quotes - Canadian stock quotes and charts for TSX and TSX Venture Stocks, regular trading hours from 9:30 am to 4:00 pm Eastern Time. Real-Time Stock Quotes.

Features Day-Trading Tips - A Day-Trading Formula that works with any Stock, Day trading tips for using Level 2 Quotes from your broker, this gives you an advantage.

Features a market makers list and brokerage firms, track the big picture, track the buy and sell orders, and the total stock shares traded by the market maker or specialist. For the top online stock brokers see our Online Stock Trading Broker List.

Features Stock Quotes Research, lookup stocks, earnings reports, historical charts, upgrades or downgrades and Insider Trends Buy Hold or Sell indicators. You can also research a stocks trading price current high and low for the day, check stock trading volume yield and change. Lookup stock earnings insider trading information stock announcements, upgrades or downgrades and stock holdings information change in stock ownership.

The futures trading markets are a meeting place for buyers and sellers of many different commodities futures like financial futures, oil futures, gold futures, silver futures, copper futures and many more.

Level II Stock Charts

Features live up to the minute stock market charts and stock quotes. Also features live headline news for your stocks and the stock watch-list to keep track of your stocks.

Features live candlestick stock charts, stock chart - Volume, Strength, MACD and Divergence. Pre-market and after market charts. Plus technical analysis for day traders to spot trends.

Features Stock Trading Tips for day traders or investors, Real Stock Trading Tips and advise you can use in today's stock market. The Asian and European markets can be used as a possible guide to get an idea of which direction the US market is likely to go in.

Forex Trading Currency Pairs, Free Quotes and Charts - Forex Trading Currencies features candlestick charts and quotes for XAU/USD - GOLD Dollar Rates, XAG/USD - SILVER Dollar Rates or EUR/USD - Euro Fx / U.S. Dollar, Canadian Dollar and many more currency pairs. Watch for trends spot entry and exit points, view current bid and ask prices.

The trading floor of the futures exchange, with all the shouting and signaling to buy or sell Futures Commodities does give the direct impression of chaos.

Floor Traders - Trader Article for Investors.

Futures Hedging - Hedgers Article the Benefits.

Futures Contract - Futures type of Contract.

Futures Commodities - Futures Commodities

Stock Market Trading Books for Beginners and Professionals:

Most Recent Updates

Clear your Browser Cache

Market Data

Market Data Information

© 2008-2024 Level2StockQuotes.com, Max Handy Gadgets All Rights Reserved.

Copyright and Disclaimer - Privacy Policy

Copyright and Disclaimer - Privacy Policy