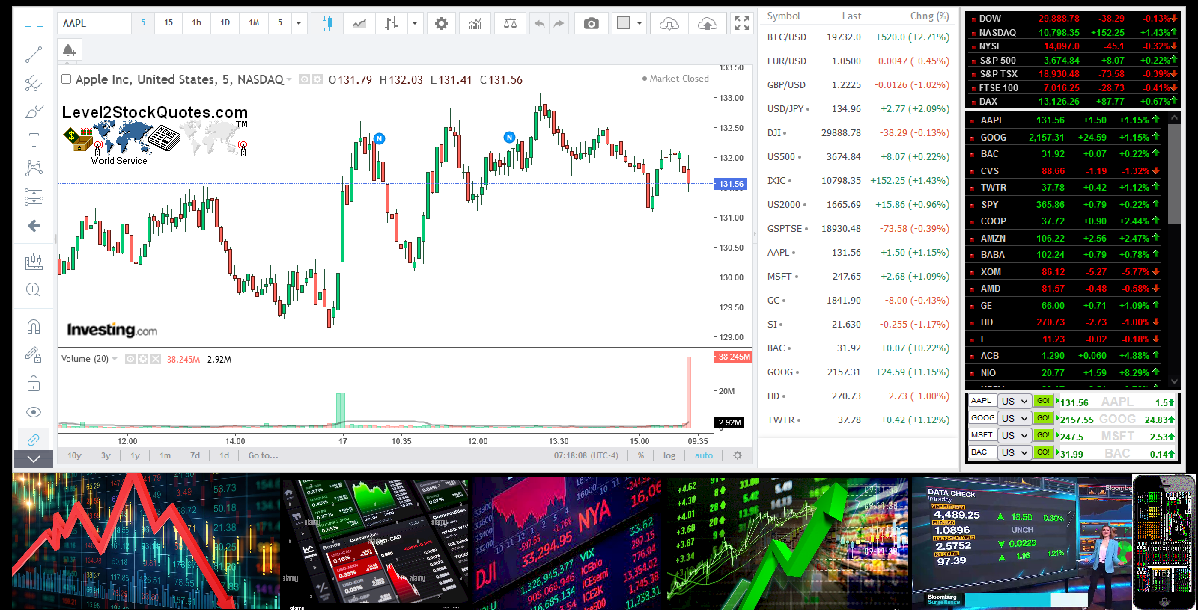

Level2StockQuotes.com

Level2StockQuotes.com

For Day Traders and Investors..

Level II Stock Quotes

US Day Traders and Investors..

Live Stock Charts

Live Stock Charts for Indicators..

TSX Stock Quotes

CA TSX Traders and Investors..

Level2StockQuotes.com - Stock Trading Tips - Intraday Day Trading Tips Articles...

Real Stock Trading Tips and advise for intraday day traders, various stock trading tips that are used primarily as technicals...

Stock Trading Tips - How to use indicators for buying and selling - signals...

Real Stock Trading Tips and advise for intraday day traders, various stock trading tips that are used primarily as technical indicators for buy or sell signals. These stock trading tips give you an advantage for decision making in the stock market.

Below is a checklist of stock trading tips and advise to refer to when trading:

If the MACD lead stochastic crosses over the 20 band consider this a possible buy signal, and if it crosses below 80, then it would be a sell signal.

Be sure you use several real time stock quotes and charts in different time periods for each stock you are trading. 60, 13, 8, 3, and 1 minute charts will enable you to see the bigger picture. If the 60, 13, and 8 minute charts are in an up-trend, look at the 3 and 1 minute charts for an entry into the trend, such as when the lead MACD stochastic moves up from the 20 band. Don't fight the trend of the longer time frames, but if your trade is going against the major trend, be aware that you won't want to stay in it for too long.

If you are new to stock trading, start with small lots of shares such as 100, and avoid jumping in with big orders for 500 or 1000+. A trade with 100 shares going against you is psychologically easier to take than one with 500 or 1000 shares.

Be leery and cautious of making trades during a consolidation period, which can be indicated by flat or nearly flat 5 and 15 period moving averages. It is best to make trades when the stock is in a trend identified by a stock going higher and the lows are higher and higher signaling an up-trend, or lower highs and lower lows for a downtrend. A strong trend should show a wide gap between the 5 and 15 period moving averages.

Note Stock Price: If the price is consolidated into a tight range for the past several bars, be aware that a breakout may be triggered this could be a very fast movement, when the price moves above or below the highest or lowest values. You can either enter a trade at the breakout price as it happens, or wait for the first wave to complete and the price to pull back close to the original breakout price.

Know where your exit points are in the trade, including your stop loss value. It is important to take losses and not let a losing trade run away while you hope it will turn in your favor later on.. it might not. Set a stop loss and stick to it.

If trading NASDAQ stocks, be aware of what the futures are doing. The current March contract symbol for the Nasdaq E-mini 100 futures is listed below depending on your broker. Stocks usually move with the futures. It is generally a bad idea to short a stock if the futures are in a strong up-trend, and vice versa for going long.

List of E-mini Symbols:

Micro E-mini S & P 500 Symbol /MES Minimum Tick Size 0.25 = $1.25

Micro E-mini Nasdaq 100 Symbol /MNQ Minimum Tick Size 0.25 = $0.50

Micro E-mini Russell 2000 Symbol /M2K Minimum Tick Size 0.1 = $0.50

Micro E-mini DOW Symbol /MYM

If the futures are in an up-trend, but your stock is moving down this could signal a possible explosive move down when the futures start to go back down again. The same applies in reverse for moves up.

Look at the previous days trading range by subtracting the high of the day from the low of the day. You may want to add this into a stock scanning program so you can find stocks which had a range of $1+ for example. Stocks with large ranges will give more opportunities for larger moves for you to capture compared to stocks which only fluctuate by a few cents each day.

Watch out for stocks that have a significant gap at the open, either up or down. Stocks that have gapped are likely to have good volume and swings in price, presenting good trading opportunities. A gap is defined by the opening of the bar being greater or less than the close of the previous bar. If a stock closed at $85 yesterday and opened at $88 today, then it has gapped up by $3.

Stock Trading Tips - Intraday Day Trading Tips Articles Continued...

World Charts - Trading Snapshot News Articles

US CA Level 2 Mobile

CA Level 2 Mobile

CA Level 2 Mobile FX Level 2 Mobile

US Level 2 Mobile Level 2 stock quotes mobile is setup for all Mobile Devices - Featuring realtime stock quotes on your ipad, iphone or smart phone. Live Stock Charts and Stock Market TV News plus Stock Trading Snapshot News Articles, stock market watch list and day trading tips. For Stock Trading Snapshot News Articles simply select from the Drop-Down Chart Menu above. Use the Stock Market Movers and Stock Screener section to find stocks that are moving fast or have reached a new high or low with volume coming in fast. Forex Trading Currencies see the Forex or FX section in any of the drop-down menus for charts and quotes for GOLD, SILVER or Dollar Rates, Canadian Dollar and many more. For free Level II Stock Quotes click on LII-Book button.

Stock Trading Tips - Intraday Day Trading Tips Articles Continued...

Note: All you are trying to do is to make an educated estimate to what direction a given stock is moving. The market makers use this formula and most day traders use it all throughout the day to keep a sharp eye on stocks they have.Note: Some stocks pullback or dip in the morning if your stock does that's in your favor so have three prices figured out on paper so you can make a quick decision.

If you are going to day-trade you need to be quick and confident with a plan and know your exit before you enter and visa versa.

For individual investors: For investors, individuals who completely understand the risks and can afford the loss involved can allocate a portion of their capital to futures trading.. This will greatly diversify your portfolio and can be a means of achieving a higher overall return on your investments. Combining futures trading with stocks and bonds is a great way to minimize the risk and become more diversified.

Article By: David L. - Level2StockQuotes.com

For More Information: See our What are Level I, II and III Quotes Section.

How to use Level II Quotes for Day Trading - Features Day-Trading Tips - A formula that works with any Stock.

Futures Trading Hedgers: The principle of hedgers is simple but can be somewhat complex. In this article we attempt to clarify futures hedgers and what benefit they have. The hedgers in the futures market buy and sell futures contracts mainly to establish a price level many weeks or even months in advance.

Futures cash settlement is simply the holding of a cash settled future until expiration. At that time, there is a final margin payment, and the contract expires.

Level II Stock Quotes

For NASDAQ, NYSE and AMEX stocks. Level II Stock Quotes also features live stock charts, most active stocks and stock market news. For level II quotes click on LII-Book button.

Features free level 2 stock quotes, live stock charts, most active stocks, stock market watch list and stock market news for NASDAQ, NYSE, AMEX stocks. Market hours 4:00 am to 8:00 pm.

Features live stock quotes, stock market watch list, news and live candlestick stock charts for NASDAQ, NYSE, AMEX and OTCBB stocks. You can see what a stock is doing, watch the open and close of the stock trade and compare to the previous trade to give you a better view.

Features real time NASDAQ, NYSE and AMEX, hot Penny stocks that are trading up in today's session and are below $5 dollars with volume coming in moving the stock market price higher. Volume is also an indicator of a stocks momentum and if you get in early, the earnings potential is at it's greatest, just make sure your on the right side of the trade and don't fight against the overall market trend.

Thousands of stock transactions take place everyday, not only in the United States but also all over the world. When a stock is bought and sold, it has two kinds of prices, a bid price and an ask price. The bid price is what someone is willing to pay for the stock.

CA TSX Stock Quotes

Features Free real-time stock quotes - Canadian stock quotes and charts for TSX and TSX Venture Stocks, regular trading hours from 9:30 am to 4:00 pm Eastern Time. Real-Time Stock Quotes.

Features Day-Trading Tips - A Day-Trading Formula that works with any Stock, Day trading tips for using Level 2 Quotes from your broker, this gives you an advantage.

Features a market makers list and brokerage firms, track the big picture, track the buy and sell orders, and the total stock shares traded by the market maker or specialist. For the top online stock brokers see our Online Stock Trading Broker List.

Features Stock Quotes Research, lookup stocks, earnings reports, historical charts, upgrades or downgrades and Insider Trends Buy Hold or Sell indicators. You can also research a stocks trading price current high and low for the day, check stock trading volume yield and change. Lookup stock earnings insider trading information stock announcements, upgrades or downgrades and stock holdings information change in stock ownership.

The futures trading markets are a meeting place for buyers and sellers of many different commodities futures like financial futures, oil futures, gold futures, silver futures, copper futures and many more.

Level II Stock Charts

Features live up to the minute stock market charts and stock quotes. Also features live headline news for your stocks and the stock watch-list to keep track of your stocks.

Features live candlestick stock charts, stock chart - Volume, Strength, MACD and Divergence. Pre-market and after market charts. Plus technical analysis for day traders to spot trends.

Features Stock Trading Tips for day traders or investors, Real Stock Trading Tips and advise you can use in today's stock market. The Asian and European markets can be used as a possible guide to get an idea of which direction the US market is likely to go in.

Forex Trading Currency Pairs, Free Quotes and Charts - Forex Trading Currencies features candlestick charts and quotes for XAU/USD - GOLD Dollar Rates, XAG/USD - SILVER Dollar Rates or EUR/USD - Euro Fx / U.S. Dollar, Canadian Dollar and many more currency pairs. Watch for trends spot entry and exit points, view current bid and ask prices.

The trading floor of the futures exchange, with all the shouting and signaling to buy or sell Futures Commodities does give the direct impression of chaos.

Floor Traders - Trader Article for Investors.

Futures Hedging - Hedgers Article the Benefits.

Futures Contract - Futures type of Contract.

Futures Commodities - Futures Commodities

Stock Market Trading Books for Beginners and Professionals:

Most Recent Updates

Clear your Browser Cache

Market Data

Market Data Information

© 2008-2024 Level2StockQuotes.com, Max Handy Gadgets All Rights Reserved.

Copyright and Disclaimer - Privacy Policy

Copyright and Disclaimer - Privacy Policy