Level2StockQuotes.com

Level2StockQuotes.com

For Day Traders and Investors..

Level II Stock Quotes

US Day Traders and Investors..

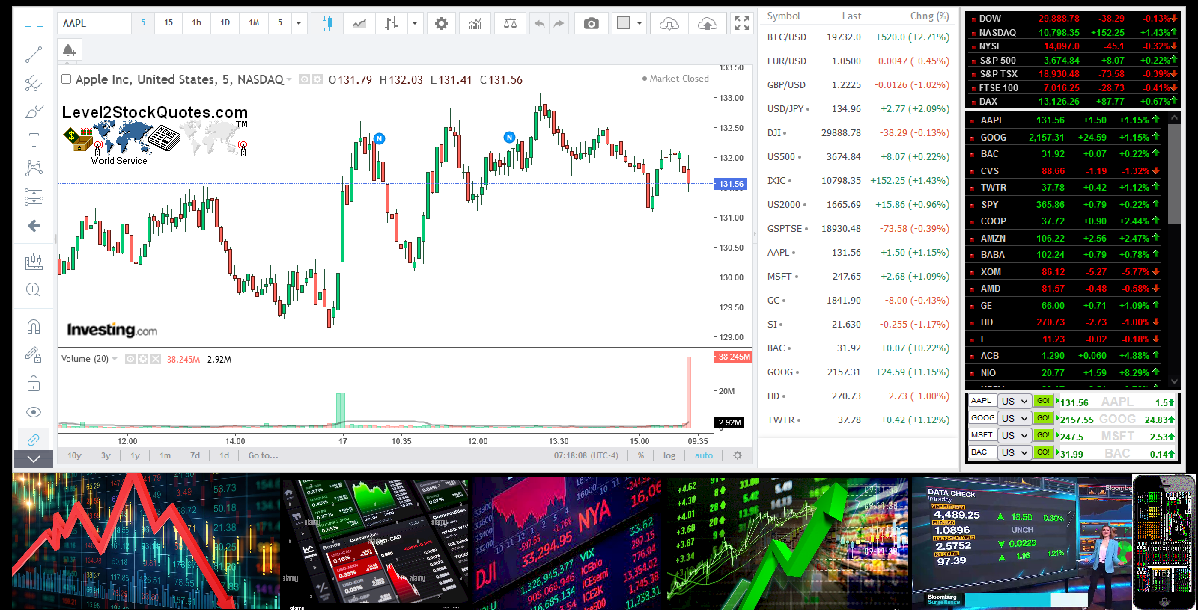

Live Stock Charts

Live Stock Charts for Indicators..

TSX Stock Quotes

CA TSX Traders and Investors..

Stock Market - Market Makers List - A to Z

Features a market makers directory list from a-z, there are more than 600 member firms that act as NASDAQ Market Makers...

Market Makers List Information and Legend:

MPID: The identifier for each market participant. In cases where a Market-Making firm trades a security from a location other than its main trading location, a fifth-letter may be appended to the Market Makers identifier for that security. Each Market Maker is free to use any letter to designate a specific branch location as desired.

MP Type:

There are several types of NASDAQ participants. Listed below are the characters used with its corresponding market participant type.

A = Agency Quote

C = Electronic Communications Network (ECN)

E = Exchange

M = Market Maker

N = Miscellaneous

O = Order Entry Firm

P = NASDAQ Participant

Q = Query Only Firm

S = Specialist

Name:

The firm name of the Market Participant.

Location:

The geographic location or the trading desk(s) name of the firm.

Phone Number:

The telephone number of the geographic location or trading desk of the firm.

NASDAQ Member:

Indicates whether a Market Participant is a member of the NASDAQ Exchange. Possible values are:

Y = Yes, MP is a NASDAQ exchange member

N = No, MP is not a NASDAQ exchange member

FINRA Member:

Indicates whether a Market Participant is a member of the Financial Regulatory Authority (FINRA)

Y = Yes, MP is a FINRA member

N = No, MP is not a FINRA member

NASDAQ BX Member:

Indicates whether a Market Participant is currently a member of the Boston Stock Exchange (BSE) or a market participant on the former BSE equity trading platform. It is expected that such Market Participants will continue to have trading rights on a NASDAQ BX equity trading platform.

Y = Yes, MP is a NASDAQ BX member

N = No, MP is not a NASDAQ BX member

PSX Participant:

Indicates whether a MP is currently a member of NASDAQ OMX PHLXSM (PHLX00ae) and eligible to trade on PSX..

Y = Yes, MP is a PHLX member, eligible to trade on PSX

N = No, MP is not eligible to trade PSX

More Information:

A market maker is a firm who quotes both a buy and a sell price in a financial instrument or commodity, hoping to make a profit on the turn or the bid/offer spread.

In foreign exchange trading, where most deals are conducted Over-the-Counter and are, therefore, completely virtual, the market maker sells to and buys from its clients. Hence, the client's loss and the spread is the market-maker firm's profit, which gets thus compensated for the effort of providing liquidity in a competitive market. This extra liquidity reduces transaction costs and therefore facilitates trades for the clients, who would otherwise have to accept a worse price or even not be able to trade at all. Most foreign exchange trading firms are market makers and so are many banks, although not in all currency markets.

Market Makers Info A-Z Continued...

World Charts - Trading Snapshot News Articles

US CA Level 2 Mobile

CA Level 2 Mobile

CA Level 2 Mobile FX Level 2 Mobile

US Level 2 Mobile Level 2 stock quotes mobile is setup for all Mobile Devices - Featuring realtime stock quotes on your ipad, iphone or smart phone. Live Stock Charts and Stock Market TV News plus Stock Trading Snapshot News Articles, stock market watch list and day trading tips. For Stock Trading Snapshot News Articles simply select from the Drop-Down Chart Menu above. Use the Stock Market Movers and Stock Screener section to find stocks that are moving fast or have reached a new high or low with volume coming in fast. Forex Trading Currencies see the Forex or FX section in any of the drop-down menus for charts and quotes for GOLD, SILVER or Dollar Rates, Canadian Dollar and many more. For free Level II Stock Quotes click on LII-Book button.

Market Makers Info A-Z Continued....

Most stock exchanges operate on a matched bargain or order driven basis. In such a system there are no designated or official market makers, but market makers nevertheless exist. When a buyer's bid meets a seller's offer or vice versa, the stock exchange's matching system will decide that a deal has been executed.In the United States, the New York Stock Exchange (NYSE) and American Stock Exchange (AMEX), among others, have a single exchange member, known as the "specialist," who acts as the official market maker for a given security. In return for a) providing a required amount of liquidity to the security's market, b) taking the other side of trades when there are short-term buy-and-sell-side imbalances in customer orders, and c) attempting to prevent excess volatility, the specialist is granted various informational and trade execution advantages.

Other U.S. exchanges, most prominently the NASDAQ Stock Exchange, employ several competing official market makers in a security. These market makers are required to maintain two-sided markets during exchange hours and are obligated to buy and sell at their displayed bids and offers. In most situations, only official market makers are permitted to engage in naked shorting.

On the London Stock Exchange (LSE) there are official market makers for many securities (but not for shares in the largest and most heavily traded companies, which instead use an automated system called TradElect). It is their prices which are displayed on the Stock Exchange Automated Quotation system, and it is with them that ordinary stockbrokers generally have to deal when buying or selling stock on behalf of their clients.

Proponents of the official market making system claim market makers add to the liquidity and depth of the market by taking a short or long position for a time, thus assuming some risk, in return for hopefully making a small profit. On the LSE one can always buy and sell stock: each stock always has at least two market makers and they are obliged to deal.

This contrasts with some of the smaller order driven markets. Unofficial market makers are free to operate on order driven markets or, indeed, on the LSE.

Market Makers - A-Z List:

A - B - C - D - E - F - G - H - I - J - K - L - M - N - O - P - Q - R - S - T - U - V - W - X - Y - Z

Level II Stock Quotes

For NASDAQ, NYSE and AMEX stocks. Level II Stock Quotes also features live stock charts, most active stocks and stock market news. For level II quotes click on LII-Book button.

Features free level 2 stock quotes, live stock charts, most active stocks, stock market watch list and stock market news for NASDAQ, NYSE, AMEX stocks. Market hours 4:00 am to 8:00 pm.

Features live stock quotes, stock market watch list, news and live candlestick stock charts for NASDAQ, NYSE, AMEX and OTCBB stocks. You can see what a stock is doing, watch the open and close of the stock trade and compare to the previous trade to give you a better view.

Features real time NASDAQ, NYSE and AMEX, hot Penny stocks that are trading up in today's session and are below $5 dollars with volume coming in moving the stock market price higher. Volume is also an indicator of a stocks momentum and if you get in early, the earnings potential is at it's greatest, just make sure your on the right side of the trade and don't fight against the overall market trend.

Thousands of stock transactions take place everyday, not only in the United States but also all over the world. When a stock is bought and sold, it has two kinds of prices, a bid price and an ask price. The bid price is what someone is willing to pay for the stock.

CA TSX Stock Quotes

Features Free real-time stock quotes - Canadian stock quotes and charts for TSX and TSX Venture Stocks, regular trading hours from 9:30 am to 4:00 pm Eastern Time. Real-Time Stock Quotes.

Features Day-Trading Tips - A Day-Trading Formula that works with any Stock, Day trading tips for using Level 2 Quotes from your broker, this gives you an advantage.

Features a market makers list and brokerage firms, track the big picture, track the buy and sell orders, and the total stock shares traded by the market maker or specialist. For the top online stock brokers see our Online Stock Trading Broker List.

Features Stock Quotes Research, lookup stocks, earnings reports, historical charts, upgrades or downgrades and Insider Trends Buy Hold or Sell indicators. You can also research a stocks trading price current high and low for the day, check stock trading volume yield and change. Lookup stock earnings insider trading information stock announcements, upgrades or downgrades and stock holdings information change in stock ownership.

The futures trading markets are a meeting place for buyers and sellers of many different commodities futures like financial futures, oil futures, gold futures, silver futures, copper futures and many more.

Level II Stock Charts

Features live up to the minute stock market charts and stock quotes. Also features live headline news for your stocks and the stock watch-list to keep track of your stocks.

Features live candlestick stock charts, stock chart - Volume, Strength, MACD and Divergence. Pre-market and after market charts. Plus technical analysis for day traders to spot trends.

Features Stock Trading Tips for day traders or investors, Real Stock Trading Tips and advise you can use in today's stock market. The Asian and European markets can be used as a possible guide to get an idea of which direction the US market is likely to go in.

Forex Trading Currency Pairs, Free Quotes and Charts - Forex Trading Currencies features candlestick charts and quotes for XAU/USD - GOLD Dollar Rates, XAG/USD - SILVER Dollar Rates or EUR/USD - Euro Fx / U.S. Dollar, Canadian Dollar and many more currency pairs. Watch for trends spot entry and exit points, view current bid and ask prices.

The trading floor of the futures exchange, with all the shouting and signaling to buy or sell Futures Commodities does give the direct impression of chaos.

Floor Traders - Trader Article for Investors.

Futures Hedging - Hedgers Article the Benefits.

Futures Contract - Futures type of Contract.

Futures Commodities - Futures Commodities

Stock Market Trading Books for Beginners and Professionals:

Most Recent Updates

Clear your Browser Cache

Market Data

Market Data Information

© 2008-2023 Level2StockQuotes.com, Max Handy Gadgets All Rights Reserved.

Copyright and Disclaimer - Privacy Policy

Copyright and Disclaimer - Privacy Policy